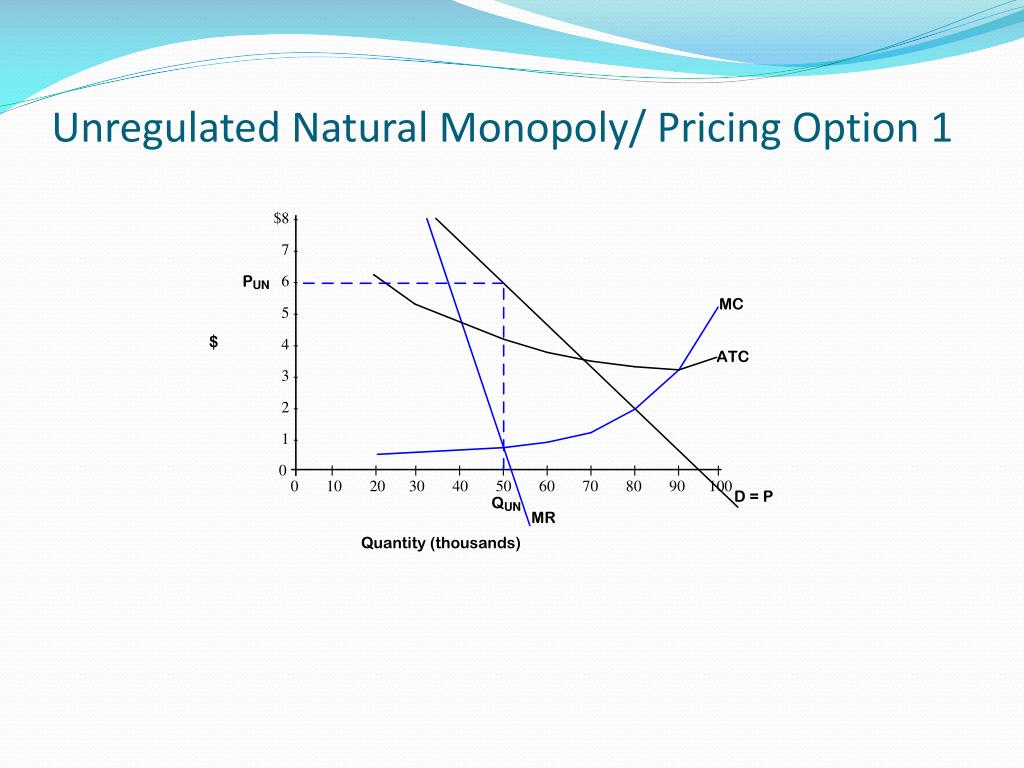

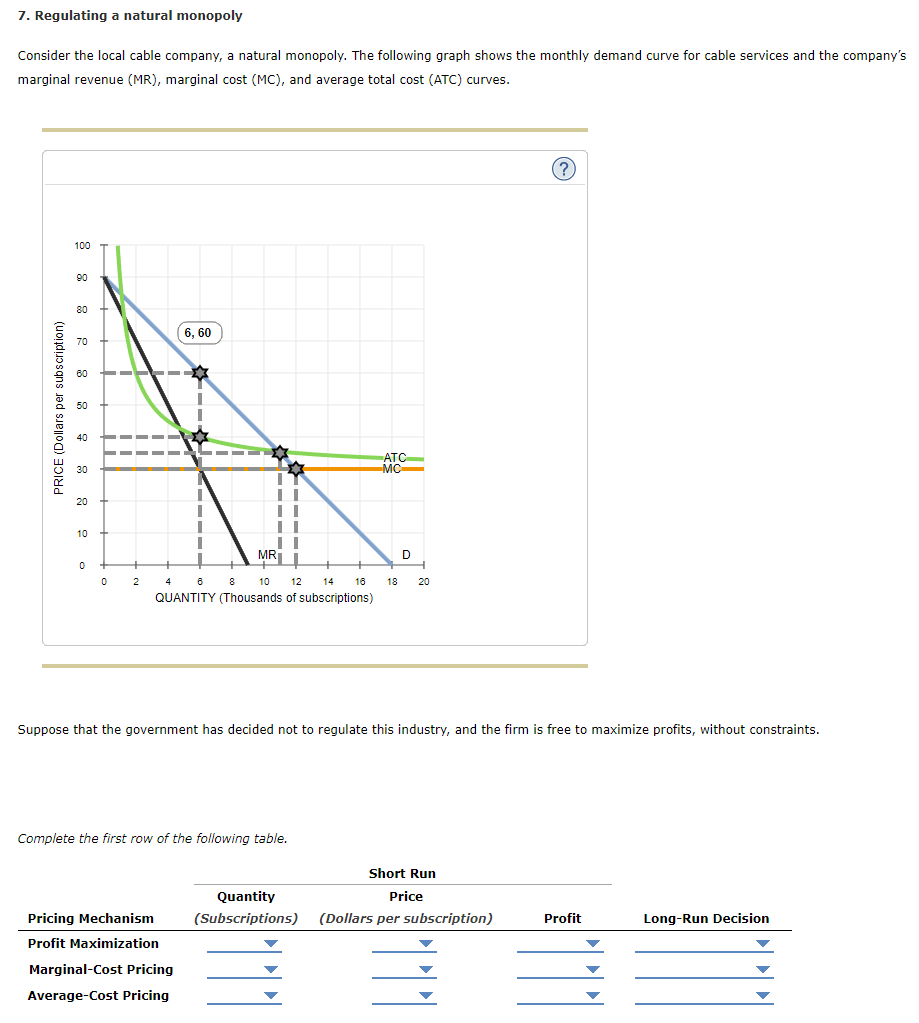

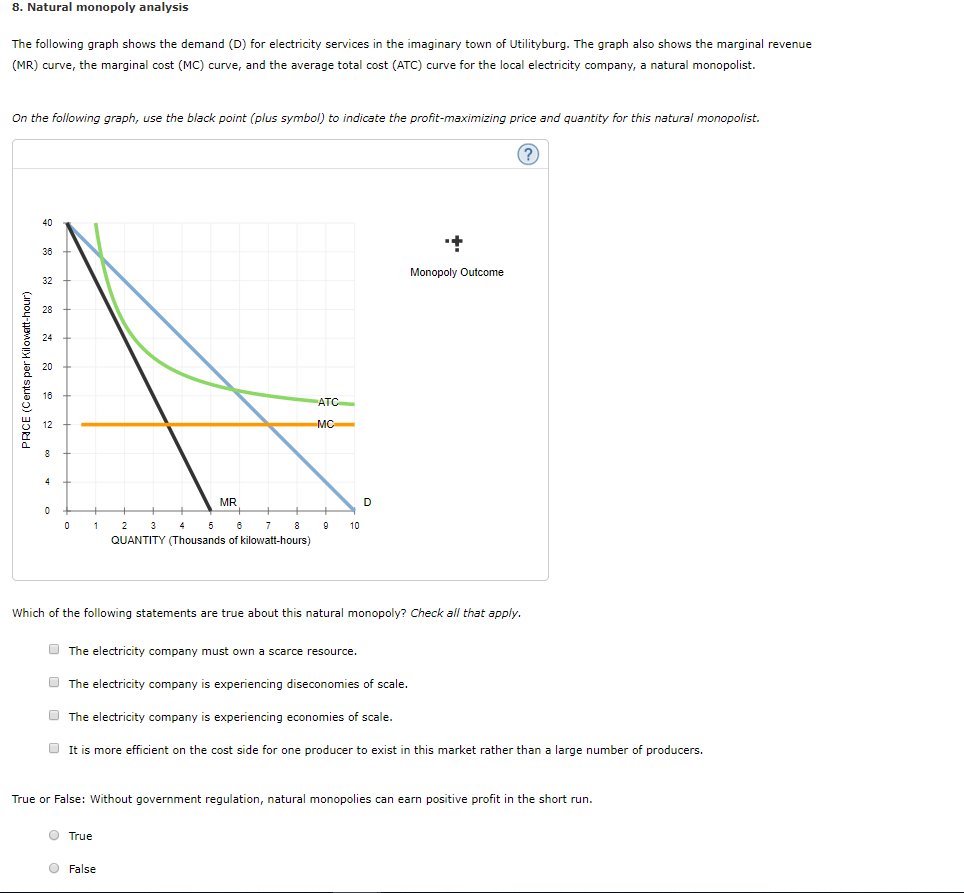

The monopolist sells OX units at price OP. In Figure 20 we see that the MC Price is OP which is determined by point E where P = MC. 19 explains an ease when MC pricing leads to losses. In that ease, the MC pricing can lead to losses to the monopolist. Since natural monopolies benefit from economies of scale, LMC is likely to be less than LAC in the relevant range of output. The monopolist will never increase output beyond X 2, in which case he would incur losses. Any wrong judgment will lead to long term inefficient allocation of resources and losses. The economist’s opinion differs regarding whether this return is a ‘fair’ return or not.

The monopolist earns normal profits which are included in the cost structure. The monopolist sells OX 2 units of output at priceOP 2. The regulating authority can set an even lower price equal to AC rule i.e., P = AC. The profit earned is E 1A per unit or total profit shown by the shaded rectangle P 1E 1AB. The monopolist sells X 1 units at price P 1 and earns profit. The kink at point E 1 on the demand curve causes E 1M discontinuity or vertical section of the MR curve. MN corresponds to E 1d portion of the demand curve. P 1E 1 is the segment corresponding to P 1 E 1 portion of the demand curve.

The corresponding marginal revenue curve is given by P 1E 1MN. The demand curve facing the monopolist has ‘a kink’ at point E due to MC pricing rule. The monopolist can sell any output up to X 1 at the regulated price of P 1 output greater than X 1 will be sold at declining prices as shown by E 1d portion of the demand curve. If the regulating authority decides to set the price of natural monopolies according to MC pricing i.e., where P = MC then it occurs at point E 1, the monopolist’s demand curve becomes P 1 E 1d. The objective of government is to set a maximum price below the monopoly price OP. The monopolist wants to sell OX units at price OP. It is given by OP price which is determined by point E where MR = MC. 19 illustrates the three pricing principles: the MC pricing, the AC pricing and the profit maximising pricing. It depends on the elasticity of his supply and demand for his product.įig. To what extent, the monopolist will shift the burden of a per unit tax to the consumer. Price charged increases consumers have to share the burden of the specific tax.Ĥ. The effects of a specific tax are stated below:Ģ. Point E 1 = After tax the firm is in equilibrium at point “E 1 where MR = MC 1. MC 1= The new MC curve after specific tax is levied Firm cams profit of AB per unit.ĪC 1= After government levies a specific tax on the firm, the AC increases as shown by higher AC curve AC 1. The firm produces OX units and sells at price OP. Point E = This is the equilibrium point before the tax is imposed. The effect of specific tax is show n in Figure 17 where Generally, specific tax is similar to a variable cost. Excise duty are levied on production while sale tax on sales. Further, the industry can't support two or more major players given the unique resources needed, such as land for railroad tracks, train stations, and their high-cost structures.Specific taxes are commodity taxes like excise duty and sales tax. Railroads: The railroad industry is government-sponsored, meaning their natural monopolies are allowed because it's more efficient and in the public's best interest to help it flourish.

0 kommentar(er)

0 kommentar(er)